CAPEX vs OPEX: strategies for managing budgeting in IT Projects

Budget management of the IT department and IT projects is one of the biggest headaches for CIOs and project managers. Technology investments are not exactly cheap. And not having exhaustive control over CAPEX (capital expenditures) and OPEX (operating expenses) can weigh down the financial structure of both projects and the organization as a whole.

In this post, we’ll discuss the role of CAPEX and OPEX in IT projects, how they affect financial performance, and what strategies you can use to optimize your organization’s IT portfolio budget.

What is CAPEX and OPEX?

In IT project management, CAPEX and OPEX are 2 categories of expenses that you need to manage wisely to not compromise the financial health of the projects and keep them aligned with the overall business objectives.

But let’s take it one step at a time: What are CAPEX and OPEX?

PROJECT FINANCIAL MANAGEMENT

Make every dollar count in your IT projects

Discover how Triskell Software’s financial management solution can help to bring clarity and control to your IT project finances.

What is CAPEX?

CAPEX refers to long-term investments in physical assets or infrastructure that will add value to the business over several years. They usually represent a significant expense item that is capitalized on the balance sheet and depreciated over time.

Examples of CAPEX include:

- Hardware purchases.

- Software development.

- Large-scale infrastructure project.

How to calculate CAPEX

To calculate CAPEX, you must take into account all costs associated with purchasing or upgrading physical assets, IT infrastructure or significant software investments.

For example, if a Banking company plans to purchase a new suite of IT equipment for the Finance department, the CAPEX will not only include the price of the equipment itself, but also other costs associated with the implementation and customization of that equipment. Thus, in this case the CAPEX would be:

CAPEX= total cost of the new IT equipment + installation costs + upgrades and support.

What is OPEX?

On the other hand, OPEX are recurring expenses for day-to-day business operations. It directly affects the profitability of the company, as they are expenses that are fully deducted from revenues in the period in which they occur.

Examples of OPEX would be the following:

- Maintenance.

- Support services.

- Software licenses.

- Cloud subscriptions.

How to calculate OPEX

It’s much simpler to calculate operating expenses than it is to calculate CAPEX. Just sum up all the operating costs that keep the company’s IT systems running.

SUBSCRIBE TO OUR NEWSLETTER

Get stories like this in your inbox

Key differences between CAPEX and OPEX

Understanding the differences between CAPEX and OPEX is essential for efficient IT project management. Let’s delve into the differences between the two types of expenses from several perspectives.

1. Nature of the expense

The main difference between CAPEX and OPEX lies in the nature of the expense. While CAPEX focuses on long-term investment in infrastructure for long-term growth, OPEX is more oriented towards day-to-day expenses.

CAPEX |

OPEX |

|---|---|

|

|

2. Impact on financial statements

Another difference between CAPEX and OPEX lies in how they affect financial accounts. While CAPEX has a more gradual impact on profits, OPEX affects them immediately.

CAPEX |

OPEX |

|---|---|

|

|

3. Depreciation and amortization

Expenses categorized as CAPEX can be depreciated or amortized over time. Understanding these concepts is essential to grasp how CAPEX expenses evolve over time:

- Tangible assets, like hardware or data centers, are typically depreciated over time. This means the cost is spread across the asset’s useful life. For instance, if your company invests in new servers, the initial investment is capitalized but depreciates over a period of 4 to 7 years, spreading the cost over the asset’s lifespan.

- Intangible assets, such as patents or software, are generally amortized over time. This approach spreads the cost similarly over the asset’s useful life, which reduces the impact of the expense on any single financial period.

In the case of OPEX, there is no depreciation or amortization since expenses are fully recognized in the period they occur. Therefore, OPEX has a more immediate impact on a company’s profitability, while CAPEX expenses are distributed over time.

Take control of your IT Project Budgets with Triskell

Request a demo to see how Triskell can help you better manage CAPEX and OPEX, ensuring efficient budgeting and successful project outcomes.

4. Cash flow considerations

The way CAPEX and OPEX impact a company’s cash flow requires IT leaders to balance both types of expenses to maintain a healthy cash flow while meeting operational needs.

CAPEX |

OPEX |

|---|---|

|

|

5. Flexibility

Capital investments are generally less flexible. When a company invests in assets like servers or proprietary software, it’s tied to that technology for several years, until it fully depreciates to justify the investment.

In contrast, operating expenses tend to be far more flexible. For instance, with cloud computing models or SaaS software, companies can adjust operations as needed. They can scale subscriptions and services up or down based on shifts in demand or technology. This flexibility is crucial in dynamic environments like IT.

CAPEX and OPEX in IT project management: why are they important?

Now that you have an overview of the differences between CAPEX and OPEX, it is not difficult to conclude that wisely balancing both types of expenses is key to the financial sustainability of projects. The way both costs are managed not only has a direct impact on the cash flow of projects, but also on the long-term financial health of the organization.

A poor management of the CAPEX and OPEX of your IT projects can lead to cost overruns, misalignment of priorities and cash flow problems. Let me give you a couple of examples to help you visualize it better:

- Imagine you have a project underway to migrate to cloud-based software. Here, underestimating OPEX can lead to unexpected operational costs that could have been avoided with better planning.

- On the other hand, if you mistakenly classify a CAPEX expense as OPEX, this will have a negative impact on the quality of financial reporting, as it will inflate immediate expenses to the detriment of long-term profitability.

If these examples are still not convincing enough, here are 5 other compelling reasons why you should monitor the CAPEX and OPEX of your IT projects.

1. Accurate budget planning

Let’s say, for example, that your company wants to launch a new datacenter. This will require a large initial capital investment (CAPEX). And then come all the costs related to the maintenance of that infrastructure, which fall into the OPEX category.

The bottom line is that in IT projects it is very common to have a mix of CAPEX and OPEX expenses. Separating these types of expenses will help you to adjust the budget to the reality and to the strategic financial objectives. If you miss any detail when monitoring expenses, it will end up compromising your financial planning.

2. Financial flexibility

More and more companies are leaning towards more OPEX-focused spending models, largely because of the rise of cloud services, which allow them to avoid upfront CAPEX outlays. It is a model that gives more flexibility in adjusting services according to demand.

However, in organizations with complex IT environments where OPEX and CAPEX expenses are significant, it is important to find a balance between both.

IT PORTFOLIO MANAGEMENT

Master CAPEX and OPEX for project success

Optimize your IT portfolio with Triskell Software’s capabilities to manage budgets, resources, and project outcomes in one place.

3. ROI and financial metrics

Monitoring CAPEX and OPEX also helps to evaluate and have a better control of the ROI and long-term profitability of IT initiatives.

For example, when developing in-house software, if the initial investment is large, that can reduce future operating costs compared to paying for third-party licenses every month or year.

4. Communication with stakeholders

Sometimes the challenge isn’t managing the IT project budget but explaining it to various organizational stakeholders. Understanding the financial implications of CAPEX and OPEX—and communicating them effectively to executives and investors—is crucial, as this information directly impacts:

- Profit margins.

- Cash flow projections.

- Shareholder confidence in projects.

5. Compliance and auditing

To help you distinguish between CAPEX and OPEX expenses, the following table provides a breakdown of the most common expenses in IT projects and which category they fall into. As you can see, each type of expense has different budgetary implications for how a company allocates funds, tracks spending, and reports on financial health.

CAPEX vs OPEX in IT projects: a comparison table

To help you distinguish between CAPEX and OPEX expenses, the following table provides a breakdown of the most common expenses in IT projects and which category they fall into. As you can see, each type of expense has different budgetary implications for how a company allocates funds, tracks spending, and reports on financial health.

IT expenditure |

Category |

Impact on IT Project Budgeting |

|---|---|---|

|

Server purchases |

CAPEX |

Large initial investment. Depreciates over the server’s useful life, impacting cash flow and capital allocation. |

|

Data Center construction |

CAPEX |

Significant initial investment with long-term benefits. Depreciates over several years and requires long-term financial planning. |

|

In-House Software Development |

CAPEX |

Significant investment, capitalized and amortized over time, with a major long-term budget impact. |

|

Hardware Upgrades |

CAPEX |

One-time expense to extend asset life. Amortized over time and requires capital allocation planning. |

|

Cloud Services (AWS, Azure, etc.) |

OPEX |

Ongoing operating expenses, predictable for budget planning. |

|

Technical Support & Maintenance |

OPEX |

Ongoing system maintenance costs included in annual operational budgets. |

|

Software License Renewals |

OPEX |

Typically annual or monthly fees, impacting the predictability of the operating budget. |

|

Permanent Software Licenses |

CAPEX |

One-time cost for permanent use, with upgrade costs requiring long-term budget planning. |

|

Consulting Fees for Implementations |

CAPEX |

Can be capitalized if linked to long-term assets, requiring an initial project cost allocation. |

|

Training on New Systems |

OPEX |

Considered an operational expense with an immediate impact on the long-term budget. |

|

Network Upgrades |

CAPEX |

Amortized over the asset’s useful life, requiring strategic capital investment planning. |

|

Cybersecurity Software Subscription |

OPEX |

Periodic subscription fees with flexible cost management. |

|

Infrastructure Leasing |

OPEX |

Recurring payments for leased equipment. Impacts monthly or annual OPEX, offering budget flexibility but higher long-term costs. |

|

Internet Service Provider Fees |

OPEX |

Monthly fee, systematically included in operational expenses. |

|

Peripherals (Printers, Monitors) |

CAPEX |

One-time cost for assets with a long useful life, depreciated over years. |

|

Mobile Device Management Software |

OPEX |

Periodic subscription fees, requiring regular review of the subscription. |

Best practices to track IT projects expenditures

Therefore, managing all the expenses in this table (whether CAPEX or OPEX) requires thorough planning and execution. Here are a number of best practices that will keep all of your IT department’s initiatives on budget and bring value to the business.

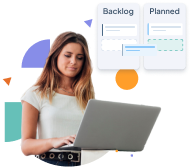

1. Use a robust project financial management tool

One of the most effective ways to track CAPEX and OPEX is by using a Project Portfolio Management software. With tools like Triskell Software, you can monitor project costs as they occur, and also generate reports to ensure that both CAPEX and OPEX remain within expected margins.

Additionally, with Triskell you can also:

- Simulate scenarios: evaluate the financial impact of different investment strategies and operations before implementing them and thus more accurately plan the IT portfolio budget.

- Align budget management with strategy: with Triskell, you can prioritize projects and their financial resources based on business objectives.

- Adjust budget allocation in real time: in addition, you can modify project budgets in real time based on changes in project scope or new market trends.

2. Align project goals with corporate financial strategy

Every IT initiative must be aligned with the organization’s overall financial strategy. Whether you want to prioritize ROI or long-term growth, it is crucial to understand how the financial management of IT projects affects the achievement of these goals.

For example, if the company you work for wants to reduce large capital expenditures, then you should prioritize investments in SaaS solutions rather than investing in in-house developed software.

Aligning the IT project budget with the financial strategy ensures that every CAPEX and OPEX decision directly supports the company’s financial objectives.

3. Implement regular financial review

Set up regular meetings to review your IT portfolio budget. These meetings will help you to compare planned versus actual expenses and, based on this analysis, adjust budgets or reallocate resources accordingly.

Pro tip: you should involve not only the Project Managers of the IT department, but also the financial controllers of the company because of the great experience they have in financial management.

4. Forecast future OPEX

For those initiatives focused on implementing cloud solutions or enrollment services, it is critical to anticipate future operating expenses to ensure that projects are adequately funded.

From historical data and consumption patterns, you can more accurately project long-term OPEX. For example, if your company plans to expand its cloud infrastructure in the coming years, you should model how subscription costs will grow and factor them into the long-term operating budget.

5. Adopt a Lean budgeting approach

And finally, in an IT environment where needs evolve very quickly, adopting a lean budgeting approach will help you manage CAPEX and OPEX more effectively.

You should prioritize investments that will really contribute to business objectives and reduce unnecessary expenses. By adopting an incremental funding approach, whereby funds are released to projects as they progress, you will be able to reassess CAPEX and OPEX needs more efficiently.

Key takeaways for effective CAPEX and OPEX management

Getting CAPEX and OPEX under control is vital to the financial health of any IT portfolio, whatever the company. As we have seen throughout the article, each affects budget planning and financial strategy in very different ways. Therefore, a financial management strategy is key to driving both the success of your IT projects and the long-term growth of your organization.

With tools like Triskell, your company can monitor, report and optimize CAPEX and OPEX and align them with business objectives. In addition, with Triskell you can adjust your project budgets in real time, simulate different scenarios and align spending with business strategy.

Take control of your IT Project Budgets with Triskell

Request a demo to see how Triskell can help you better manage CAPEX and OPEX, ensuring efficient budgeting and successful project outcomes.

Related Content

The ultimate PMO guide: roles, responsibilities and best practices for successful implementation

Learn everything about PMOs: roles, responsibilities, and best practices for successful implementation. A must-read guide for project managers..

10 best Capacity Planning software & tools in 2025: the ultimate guide

Explore the top 10 capacity planning software and tools for PPM. Compare features, pricing, and find your best fit for your business.

7 challenges in new product development and best practices to address them

In this post you will learn some best practices to tackle the major challenges in new product development, from idea validation to quality control.

FAQ CAPEX vs OPEX

How Triskell helps manage CAPEX and OPEX in IT Projects?

Triskell streamlines tracking and categorizing expenses into CAPEX and OPEX with a real-time budget monitoring system. With tools for cost projection, budget adjustments, and reporting, Triskell enables teams to manage capital investments and operating expenses precisely.

This not only improves resource allocation and project agility but also ensures that project goals align with the company’s strategic objectives.

How can businesses optimize OPEX to reduce ongoing costs?

Companies can optimize OPEX by regularly auditing software subscriptions, consolidating duplicate services, and negotiating better contracts. Automating tasks and improving process efficiency also help lower these operating costs.

Forecasting future OPEX based on usage patterns helps prevent budget overruns, making expenses more predictable and manageable over time.

How do CAPEX and OPEX affect financial reporting for IT departments?

CAPEX involves long-term investments, such as hardware and infrastructure, which are capitalized and amortized over time. This spreads the cost over multiple years, reducing short-term impact on the income statement. In contrast, OPEX covers ongoing expenses like subscriptions and maintenance, which are expensed immediately, affecting profitability in the current period.

Balancing CAPEX and OPEX is essential for IT departments. CAPEX supports long-term growth but requires careful planning, while OPEX offers flexibility but can impact short-term profitability. Triskell provides real-time insights for tracking and accurately reporting these expenses.