How to create a project budget: methods and techniques for effective project budgeting

Project budgeting is one of the most critical steps in project management. It ensures that a project operates within its financial constraints, achieving its objectives without unnecessary expenditures. A project budget isn’t just about allocating money; it’s about planning, forecasting, and managing the project’s finances to ensure objectives are met efficiently.

But how can you ensure proper financial management in projects? In this post, we’ll explore the fundamentals of creating a project budget. We’ll introduce methods and techniques to guide you in keeping your projects on track.

What is Project Budgeting? Definition and scope

Project budgeting is the process of estimating, allocating, and managing the financial resources required to successfully complete a project. This involves determining the funds needed to cover all project activities while staying within predefined financial boundaries.

PROJECT FINANCIAL MANAGEMENT

Take control of your project finances

Triskell offers comprehensive solutions to manage project costs, expenses, and cash flow.

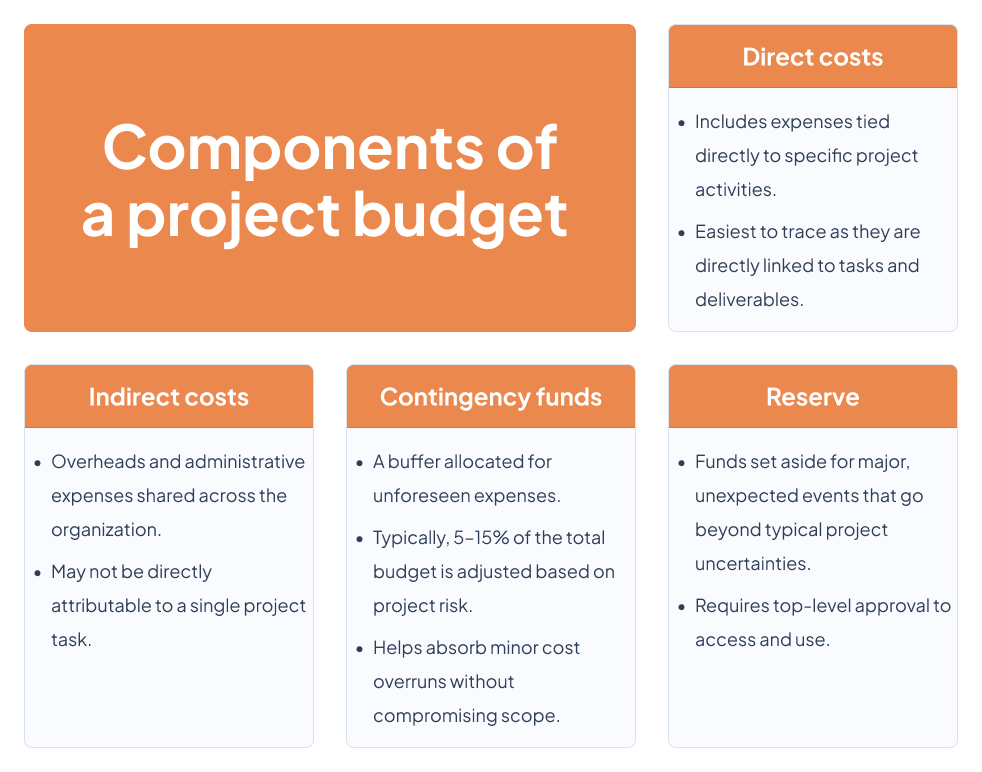

Project budgeting isn’t just about numbers. It’s a financial plan that serves as a roadmap for how resources will be allocated throughout the project lifecycle. It encompasses several key components:

- Direct costs.

- Indirect costs.

- Contingency funds.

- Reserves.

All these elements must be carefully planned and monitored to ensure the project stays within budget and schedule.

The scope of project budgeting goes beyond simply assigning funds to project phases or tasks. It involves tracking, evaluating financial performance, and adjusting the budget as necessary throughout the project lifecycle. Furthermore, it provides a framework for decision-making and risk management, ensuring that funds are used effectively to achieve project goals.

Why project budgeting is so important in PPM?

Financial management is one of the fundamental pillars of project and portfolio management (PPM), serving as a guide to align projects with business strategy. However, this is not the only reason why budgeting plays a critical role in PPM. Here are five key reasons why project budgeting is essential:

- Ensures financial control and accountability: without a budget, a project can quickly spiral out of control. A well-defined budget allows project managers to track costs and ensure all activities align with financial goals. Accountability is also strengthened as stakeholders can see how resources are allocated and assess whether the project is staying on track.

- Helps prioritize tasks: the budget acts as a guide for prioritizing tasks, ensuring that critical project elements are adequately funded while less critical areas can be scaled back if needed. This ensures that every expense delivers maximum value to the project.

- Supports risk management: project budgeting is an integral part of risk management, helping identify potential financial risks before they escalate into significant issues. By allocating contingency funds and additional reserves, you can plan for unforeseen events without compromising the project’s scope.

- Facilitates communication and builds stakeholder trust: when stakeholders—including executives, clients, and team members—can review a detailed budget and understand how funds are being spent, it fosters transparency and trust. Clear communication around financial planning strengthens collaboration and confidence in the project.

- Helps in monitoring project performance: a project budget allows you to compare actual expenses to planned expenditures, quickly identifying discrepancies and making necessary adjustments. This proactive approach ensures you can address cost overruns or resource shortages effectively, keeping the project on track.

SUBSCRIBE TO OUR NEWSLETTER

Get stories like this in your inbox

How to create a project budget? An 8-step process

The benefits of project budgeting are clear. But how do you create a budget? Developing a project budget requires meticulous planning and strategic thinking. Below, we provide a framework to effectively create a budget plan for your projects.

1. Define the project scope

The first step is to define the project scope. Let’s be clear: without clearly defined objectives, deliverables, and constraints, budgeting is nearly impossible.

Start by creating a Work Breakdown Structure (WBS) that lists all project tasks and deliverables. This document will help you identify the resources, timelines, and costs required for the project. Share it with stakeholders to validate project objectives and requirements.

A well-defined scope minimizes the risk of scope creep—unplanned additions or changes to project requirements that can significantly increase costs.

2. Identify required resources

Next, list the resources needed to execute the project smoothly. Consider all categories of resources, including:

- Human resources: assess the teams required to complete the project, defining roles, skills, and availability for each. Whether they are internal employees or external consultants, account for variables such as salaries, benefits, and overhead costs.

- Materials and equipment: list all materials and tools necessary for project execution. This may include construction materials, machinery, and safety equipment for construction projects, or licenses, servers, and cloud-based tools for software development. Use historical data and vendor rates to estimate these costs accurately.

- Facilities: evaluate whether physical spaces are needed to carry out the project. This might include offices, warehouses, or specialized production facilities. Don’t forget costs related to maintenance, utilities, or upgrades.

- External services: external parties, such as subcontractors, consultants, or third-party vendors, may account for a significant portion of the budget. Document the scope of their work, delivery timelines, and associated costs. Review their contracts for contingencies or penalties for delays.

WEBINAR

Best practices in project financial management for PMOs

3. Estimate costs

Once all resources are identified, you can create a realistic cost estimate for the project. Begin by categorizing expenses into two main types: fixed and variable costs. Simultaneously, itemize costs specific to each project task.

In the section of this post titled “Project budgeting methods and techniques you should consider”, we’ll introduce cost estimation techniques to help you budget effectively for your projects.

4. Develop the budget structure

Once you have a clearer understanding of the costs, the next step is to structure the project’s financial budget. This will make it easier to allocate the necessary funds and monitor their use efficiently.

Here are two recommended ways to break down a project budget:

- Task-level budgeting: this method involves detailing costs for each task or activity within the project. It provides a highly granular view of budget usage, which is beneficial for precise financial tracking. However, managing this level of detail can become challenging in large-scale projects.

- Phase-level budgeting: in this approach, costs are grouped by project phase. This budgeting method balances simplicity with a sufficient level of detail, making it suitable for projects with clearly defined stages and requirements.

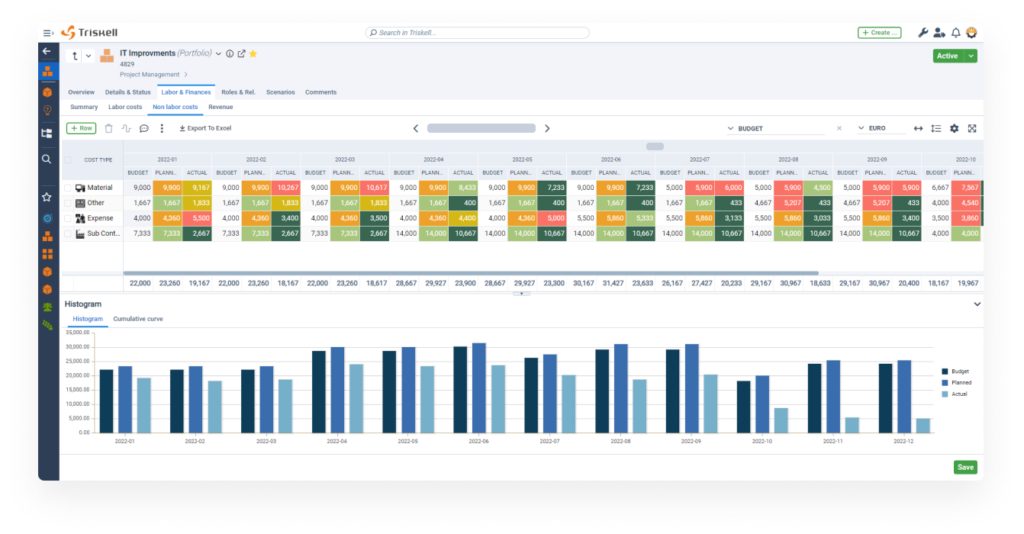

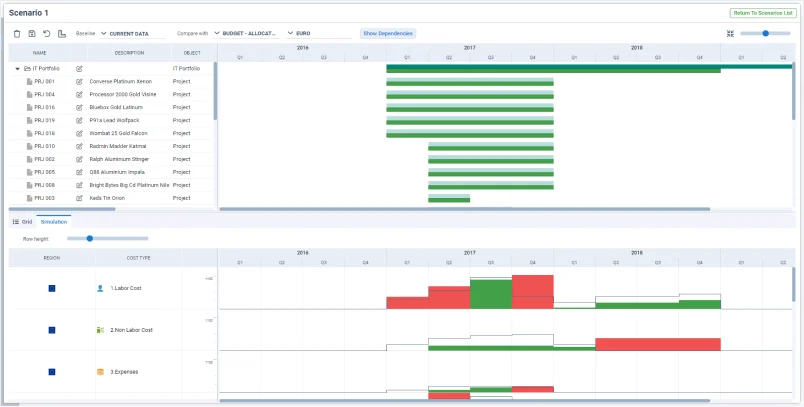

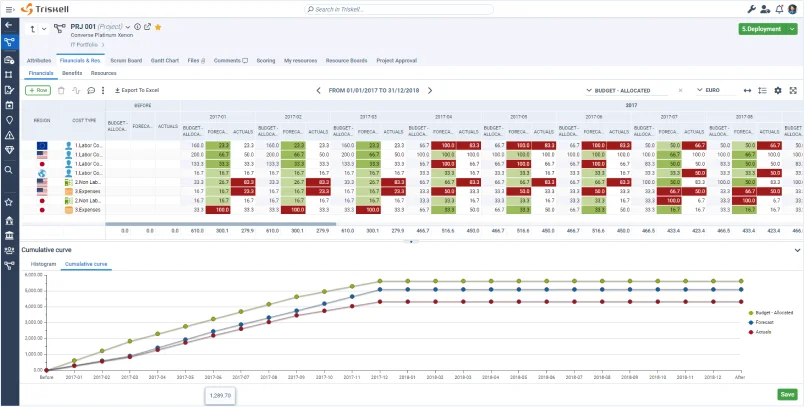

To document budgets and track expenditures in real-time, we recommend using a PPM solution like Triskell Software.

5. Review and validate the budget

Once the budget is broken down, review it with the project sponsor, team leads, and other organizational stakeholders. Verify cost estimates using data or market benchmarks to ensure decision-makers within your organization can validate the budget with confidence.

Simultaneously, conduct a risk assessment to anticipate potential project scenarios and identify possible budget deviations. Consider risks like resource shortages, supplier delays, or scope changes, and adjust the budget to account for these factors.

PROJECT PORTFOLIO MANAGEMENT

Get a holistic view of project budgeting with Triskell Software

Explore how Triskell integrates budgeting with project planning and execution for seamless financial control.

6. Implement and monitor the budget

After the budget is approved, integrate it into your overall project plan. Leverage leading PPM tools to track project expenses in real-time. These tools enable you to compare planned expenditures with actual costs, quickly identifying and addressing budget deviations.

It’s also advisable to hold regular meetings with project sponsors and teams to review the budget. Use these sessions to share progress reports and maintain transparency. Such meetings ensure swift action can be taken if the project veers off its financial plan.

7. Allocate a contingency reserve

This is a critical step. You should allocate a contingency reserve to address unforeseen expenses that may arise during the project. This reserve typically represents between 5% and 15% of the total budget, depending on the complexity and risk profile of the project.

Additionally, define specific triggers for using the contingency fund. For instance, you might reserve these funds for unexpected resource shortages or sudden increases in supplier costs. Whatever the triggers, document the processes for accessing contingency funds to ensure accountability.

8. Monitor and adjust

Budget management is not a set-it-and-forget-it task—it requires continuous monitoring to ensure alignment with the project plan. Techniques such as Earned Value Management (EVM) can help you measure project progress and financial performance effectively.

If budget deviations occur, always analyze their root causes. Communicate these adjustments proactively to stakeholders, emphasizing how these budget changes align with the project’s objectives.

Streamline project budgeting with Triskell

Request a demo today and discover how Triskell lets you accurately forecast expenses and ensure project success

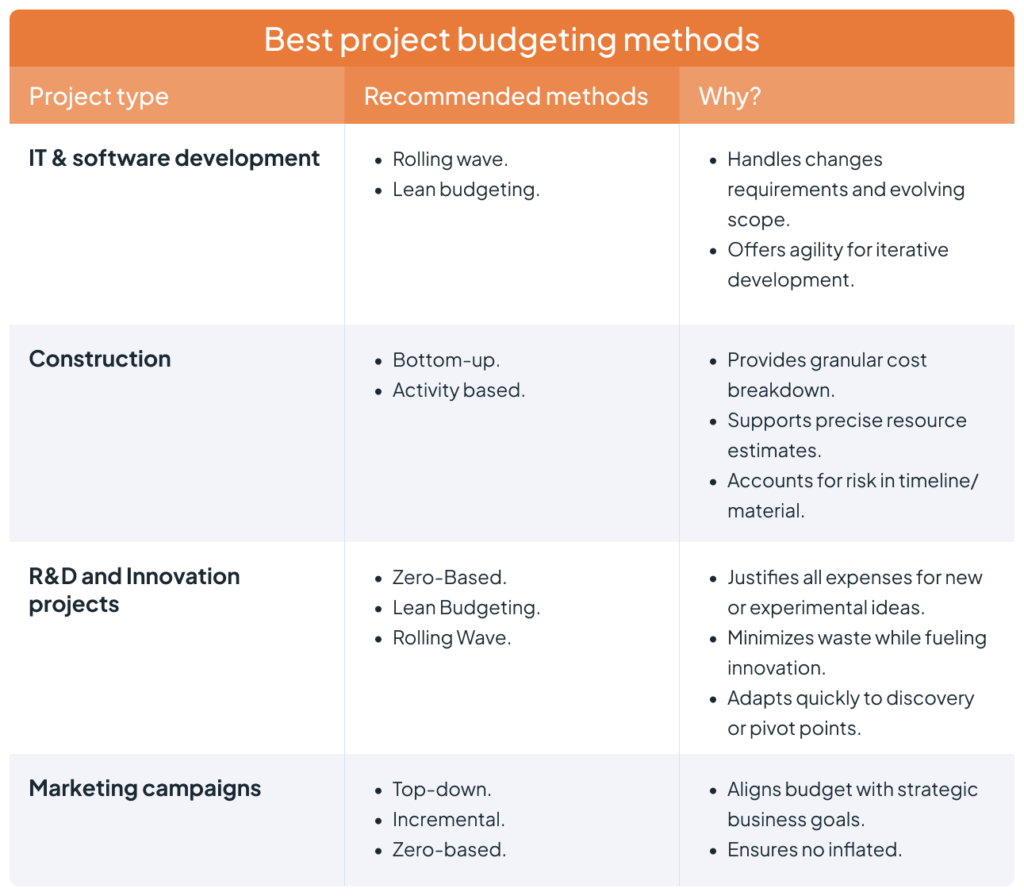

Project budgeting methods and techniques you should consider

Now you know how to create a project budget. As you can see, this process is anything but simple. To create budgets effectively on your own, you need to select the right methods and techniques based on the project’s complexity, objectives, and available resources.

Here are 9 project budgeting techniques to enhance your planning and execution.

1. Top-Down budgeting

In this approach, senior management defines the overall project budget, which is then distributed among teams and tasks. The focus is on ensuring strategic alignment with organizational goals.

This method is ideal for projects with tight deadlines or strict financial constraints. However, it may sometimes overlook practical, operational needs, potentially leading to resource constraints during execution.

Advantages |

Disadvantages |

|---|---|

|

|

2. Bottom-up budgeting

Opposite to the top-down approach, in bottom-up budgeting, each team or department estimates the costs associated with their tasks and responsibilities within the project.

This approach is ideal for complex projects where it is vital to be very accurate in estimating costs, such as in product development or construction, because it takes into account the input of those directly involved in the work. However, it is a time-consuming process that requires rigorous management to avoid budget inflations caused by overly conservative estimates.

Advantages |

Disadvantages |

|---|---|

|

|

3. Lean budgeting

Lean budgeting focuses on maximizing value while minimizing waste, ensuring resources are allocated to areas that directly contribute to project objectives. This approach is closely tied to lean project management principles, with the following key characteristics:

- Continuous evaluation of expenses to eliminate inefficiencies.

- Prioritization of high-impact activities.

This budgeting method is ideal for organizations aiming to optimize costs in dynamic environments, particularly for projects where innovation and flexibility are crucial.

Advantages |

Disadvantages |

|---|---|

|

|

4. Three-point estimation

Three-point estimation involves calculating project costs based on three scenarios: optimistic (best case), pessimistic (worst case), and most likely. These values are then combined into a weighted average to produce a more accurate and risk-adjusted estimate.

This technique is especially useful for projects with high uncertainty or multiple dependencies, as it provides a realistic range of potential outcomes and improves risk management.

Advantages |

Disadvantages |

|---|---|

|

|

5. Zero-Based budgeting

Zero-based budgeting requires justifying every expense from scratch, without reference to previous budgets. Teams must evaluate the necessity of each cost, ensuring that all resources align with the project’s current priorities.

This method is ideal for organizations aiming to maximize resource efficiency. However, it demands significant time investment to analyze each expense thoroughly, potentially causing operational disruptions if not managed carefully.

Advantages |

Disadvantages |

|---|---|

|

|

6. Incremental budgeting

Incremental budgeting is based on taking the previous period’s budget and making some adjustments to reflect changes such as inflation, new tasks or expanded scope.

This method is straightforward to implement, making it suitable for projects with minimal changes in requirements and predictable costs. However, it can encourage inefficiencies by perpetuating unnecessary past expenses and may stifle innovation by focusing on minor adjustments rather than transformative changes.

Advantages |

Disadvantages |

|---|---|

|

|

7. Analogous estimating

This approach analyzes data from similar past projects to estimate the costs of a current project. It is a quick and efficient technique, particularly useful in the early stages of project planning when detailed information for cost estimation is not yet available.

However, its effectiveness heavily relies on the accuracy and relevance of historical data and may overlook unique aspects of the current project.

Advantages |

Disadvantages |

|---|---|

|

|

8. Rolling Wave Budgeting

Rolling Wave Budgeting is an iterative approach where the budget is refined and adjusted as the project progresses to align with current needs.

This method is particularly useful for projects with high uncertainty or evolving scope, offering flexibility to adapt to changes while focusing on short-term project tasks.

Advantages |

Disadvantages |

|---|---|

|

|

9. Activity-based budgeting

Lastly, activity-based budgeting is a technique by which costs are allocated to specific project activities or tasks. It links expenses directly to project deliverables, providing a clear view of cost drivers and promoting efficient resource allocation.

It is especially effective for projects with clearly defined activities, helping optimize resources and maintain precise control over costs tied to project objectives.

Advantages |

Disadvantages |

|---|---|

|

|

Conclusion: streamline project budgeting with Triskell Software

As you can see, creating a project budget is not a small task. It’s a delicate balance of planning for the known, preparing for the unknown, and constantly adjusting as the project unfolds. And every step of this process plays a crucial role in building the financial backbone of your project.

However, even the most thorough plan can only take you so far without the right tools to back it up. That’s where Triskell Software comes in. Triskell is not just another project management tool — it´s a comprehensive PPM software with advanced features designed for financial tracking, budget management and real-time monitoring. It keeps you on top of your project’s finances, no matter how complex they get.

Take the next step toward effective project budgeting—discover how Triskell Software can transform the way you plan, manage, and execute your projects.

Streamline project budgeting with Triskell

Request a demo today and discover how Triskell lets you accurately forecast expenses and ensure project success

Related Content

Scrum board in Project Management: how to use it, examples and best practices

What is a Scrum board? Learn how to use it in Agile projects, see real-world examples, and explore best practices for maximum efficiency.

ESG principles, frameworks and best practices for Project Management

Align projects with ESG principles. Learn how companies use frameworks like GRI & SASB to meet sustainability goals and improve compliance.

10 types of Project Management Offices (PMO): structure, purpose and how to choose the right one

Learn about different PMO types, their governance levels, and which one is the best fit for your company’s project management needs.

FAQ about project budgeting

How can Triskell help manage complex project budgets?

Triskell Software is designed to handle the complexities of modern project and portfolio management. Its advanced budgeting capabilities allow you to:

- Integrate financial planning with strategic planning.

- Visualize budget performance across tasks, phases, or entire portfolios.

- Automate reporting and provide real-time updates to stakeholders.

With Triskell, managing even the most intricate budgets becomes intuitive and efficient.

What are common pitfalls to avoid when creating a project budget?

Common pitfalls include:

- Underestimating costs: Failing to account for all expenses, especially indirect costs.

- Ignoring risks: Not allocating contingency funds for unexpected events.

- Over-reliance on historical data: Assuming past projects are identical to the current one without adjustments for new variables.

Avoid these pitfalls by adopting flexible and iterative budgeting techniques, such as Rolling Wave or Three-Point Estimation.

How can you handle budget overruns in a project?

Budget overruns can be mitigated by regularly monitoring expenses using a PPM tool like Triskell. If overruns occur, analyze the root causes—whether it’s underestimations, scope changes, or unforeseen issues. Reprioritize tasks, cut non-essential expenses, or request additional funding if justified. Ensure lessons learned are documented to improve future budgeting.